Buyout loan in uae

Buyout loan:Are you stressed with too much debts and high interest rates? we can help you.

you could access additional funds and reduce your monthly payments into one single payment by applying for a Buyout Loan in UAE.

With a Buyout Loan in uae, the bank issues a personal loan that you use to pay off all your existing debts, such as credit cards and existing personal loans. The borrower is required to a pay fixed, monthly installments to the bank for a set period of time, typically two to five years to pay off his new Buyout loan. please visit our Buyout loan page to learn more.

The interest rate depends on your credit score and it usually lower than that of the existing debts. Loan Buyout is only one of several strategies for paying off debt.

A loan Buyout won’t work if the borrower has too many debts and has a bad credit score and haven’t fixed underlying spending issues.

If you are a UAE national or expat with a loan at another bank or credit cards, take control of your borrowing and consolidate all your loans into one single loan by applying for a Buyout loan with us. Learn more.

Buyout loan interest rates

Rates vary from bank to bank and depend heavily on your credit history and ability to repay, but here is what interest rate on personal loans look like, on average:

Borrowers with excellent credit and low debt-to-income ratios may qualify for interest rates at the low end of lenders’ ranges.

| Excellent | 720 – 850 | Average interest rate | 4-7% |

| Good | 690 – 719 | Average interest rate | 12-18.0% |

| Average | 630 – 689 | Average interest rate | 21.8% and above |

Docs required to apply.

Banks have their own set of docs required to process your buyout loan application. However below are some of the basic documents you must have.

- Liability Letter of all your loans and Credit cards

- 3 Months Bank statement from your salary account

- A valid Salary Certificate addressed to the bank

- Salary transfer letter might be required if its a salary transfer Loan

- Valid passport copy / original should be sighted

- Valid Emirates Id / original should be sighted

- Payslips might be required if their is varience in salary

Factors most banks consider to approve a buyout loan.

- The credit report of the applicant - only customers with a good credit score are considered for the loan.

- The DBR (debt burden ratio) must not be above 50%.

- Some Banks only consider applicants working in Listed Companies though some banks like Finance House will consider cases from non listed companies.

- Salary range. most banks require AED 5000 however some other banks require more than 5k.

- Loan Amout to be settle. not min of 30k though some banks start from 100k

How a Buyout Loan works

Which Lender is the right one for a buyout loan?

Moneymall.info has over 10 bank agents from different top banks and reputable finance companies who offer Buyout loans in uae to both UAE nationals and Expatriates. We shall help you compare and choose the best buyout loan that’s right for you. Learn more

Top banks offering buyout loans in UAE

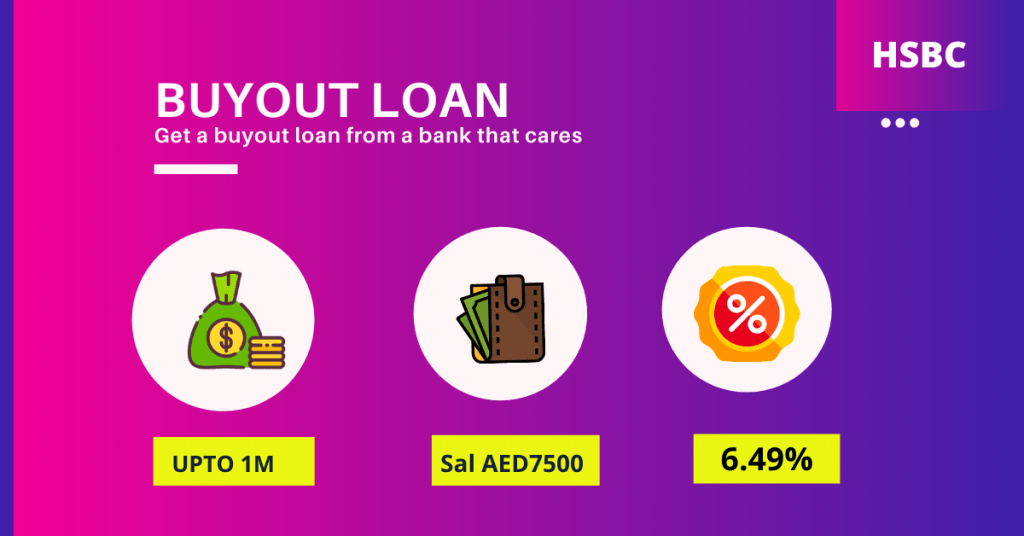

Switch to Hsbc bank quickly and easily. Get high personal loan amount at low interests with flexible repayment of up to 48 months for Expats and UAE nationals. Read more.

Interest rate | Loan amount | Repayment terms |

From as low as 6.49%* p.a. | Up to AED 1 million for UAE nationals, expats AED 750,000 | Up to 48 months |

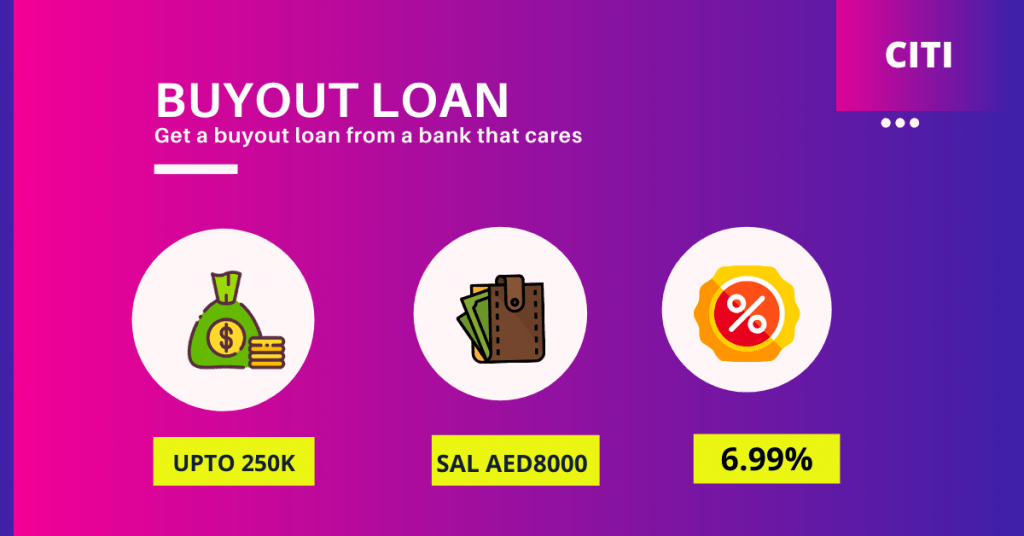

Citi Bank-Buyout Loan

Switch to citi bank quickly and easily. Get high personal loan amount at low interests with flexible repayment of up to 48 months for Expats and UAE nationals.

Interest rate | Loan amount | Repayment terms |

From as low as 6.99%* p.a. | Up to AED 250k | Up to 48 months

|

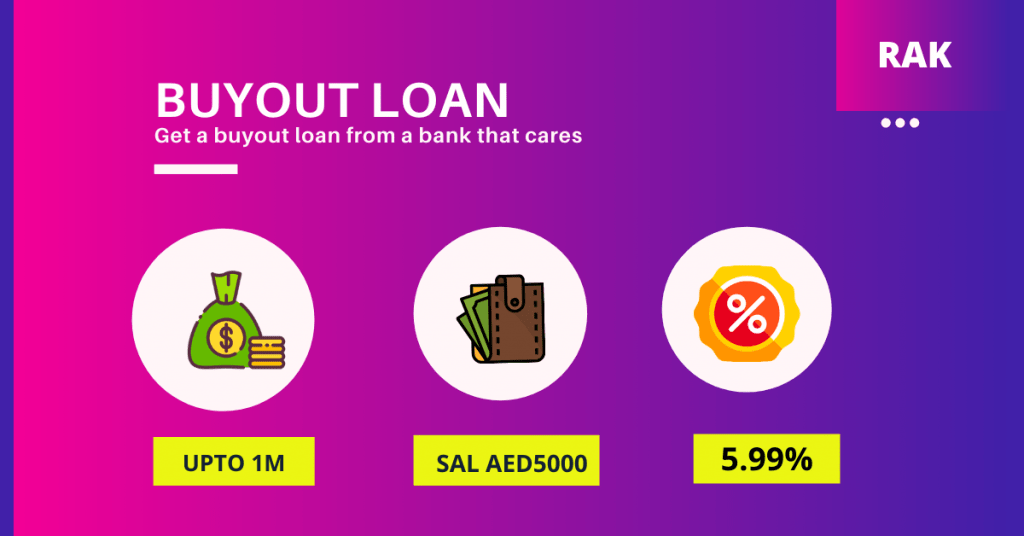

Rak Bank- Buyout Loan

Already have a personal loan in another bank. switch it to Rak bank quickly and easily. Get high personal loan amount at low interests with flexible repayment of up to 48 months for Expats and UAE nationals.

Interest rate | Loan amount | Repayment terms |

From as low as 5.99%* p.a. | Up to AED 1 million for UAE nationals | Up to 48 months |

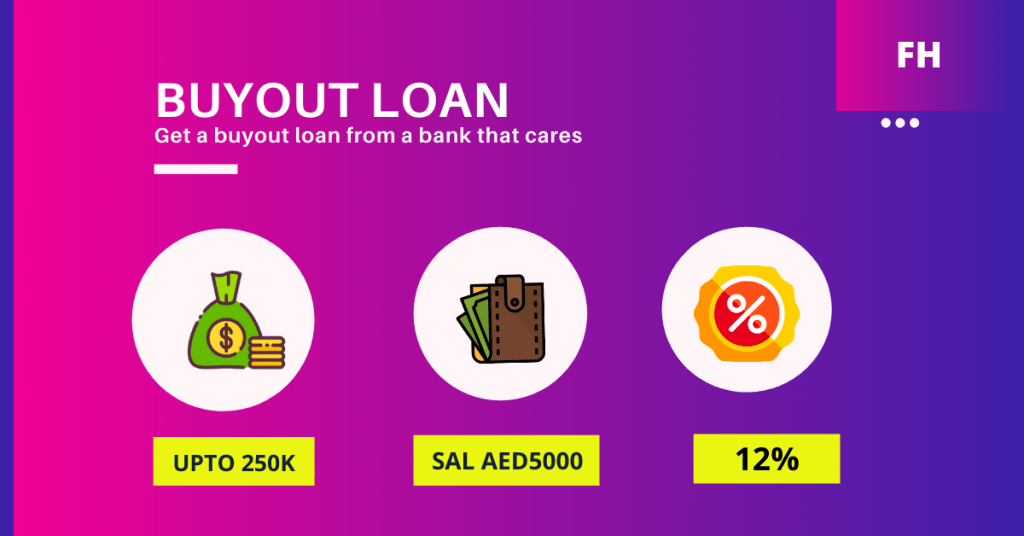

Finance House - Buyout Loan

FH offers a flexibility of a buyout loan with no salary transfer, you can access additional funds and reduce your monthly payments with our Buyout Loan.learn more

Interest rate | Loan amount | Repayment terms |

From as low as 12 % * p.a. | Up to AED 1m for UAE nationals and 200k for Exparts. | Up to 48 months |

Addition steps towards a debt free life.

If you’re planning to borrow money to pay off debt, a Buyout loan works best. Make a proper plan and create a monthly budget and start saving this will build a stronger financial future for you as you become a debt free person.

If you don’t have an immediate need for cash, work on building your credit score. A higher score will qualify you for more loan opportunities, lower interest rates and better loan terms in the future.

we at moneymall.info we are happy to help you in applying for your Buyout loan in uae. click here and Check your eligibility.

Buyout loan vs. Balance transfer loan

For borrowers with good credit, a balance transfer credit card is an alternative to a Buyout loan in UAE. Such cards have an introductory 0% interest rate, which increases after a promotional period, usually no more than 24 months.

The amount of credit card amount you can transfer is typically up to 90% of the card limit. Once the introductory period expires, the rate on a balance transfer card is usually higher than on a personal loan in UAE. In addition to paying off your balance before the rate increases, you’ll want to avoid making further charges.

A personal loan offers some advantages over balance transfer cards. Fixed payments ensure you’ll pay off debt on a set schedule. Borrowing limits are typically higher; some lenders offer loans of 200,000 DHS and more.

In addition, a personal loan may improve your credit if it means your credit card balances shrink relative to the credit limits. Your credit scores can take a hit if you use all the available credit on your cards.

A personal loan balance is reported as installment debt, which is treated differently in credit scoring formulas than revolving debt such as credit cards.